What your beliefs are about anything creates your actions. What you believe about marriage creates the way you handle your marriage. What you believe about raising kids creates the way you do that. What you believe about your career. What you believe about money. And the problem is some of us have bad beliefs. – Dave Ramsey

Editor's note: In the question and answer sections of this article, questions have been edited for length and clarity.

Twenty-five years ago, Dave Ramsey turned the hot water up and stood in the shower, the stream blasting into his face, mixing with his tears and the terror of financial ruin. "We were so scared we didn't know what to do," he said. "I would just stand there and cry."

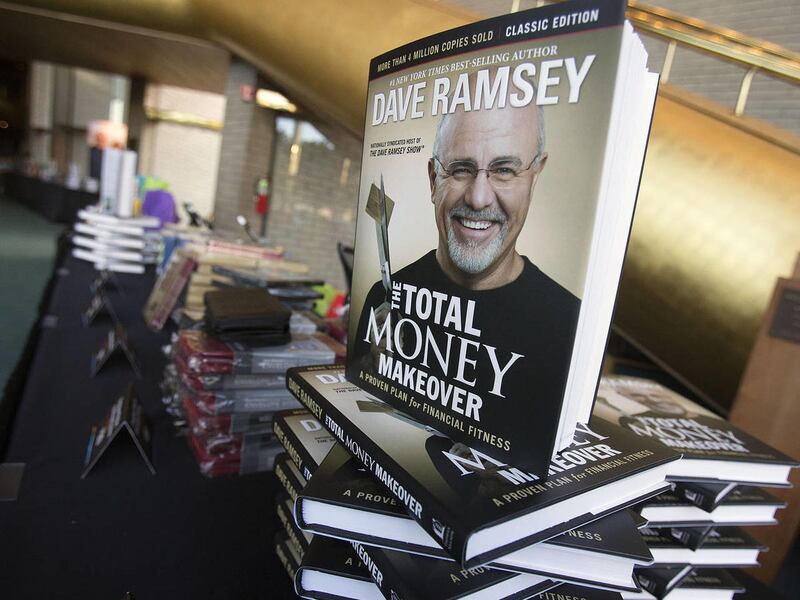

Ramsey was a hotshot real estate investor and had borrowed his way into about $4 million in properties in the Nashville area. Then it fell apart. He signed the bankruptcy papers on Sept. 22, 1988.

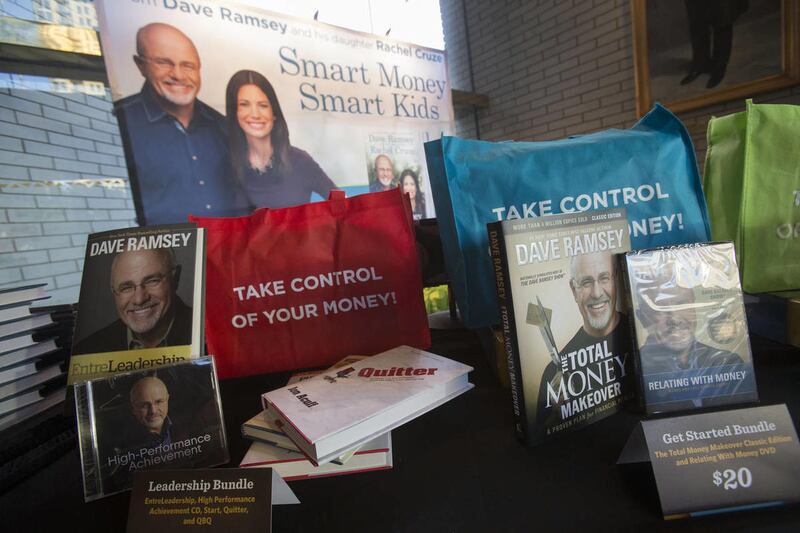

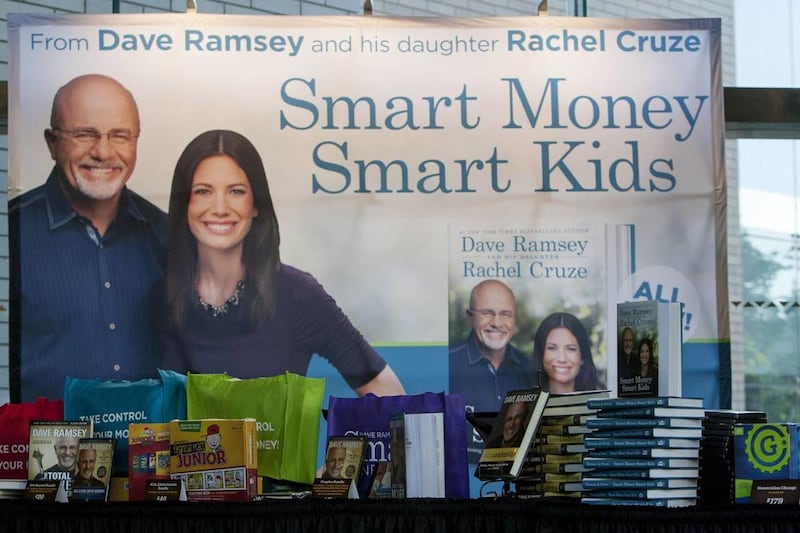

Now, more than a quarter of a century later, Ramsey walked onto the stage in Salt Lake City's Abravanel Hall, greeted by a sold-out crowd that jumped to its feet in a standing ovation before he said a word. It was one stop of his "Legacy Journey Live" personal finances event and came on the heels of a grueling promotional tour for a new book, "Smart Money Smart Kids," that he wrote with his daughter, Rachel Cruze.

The atmosphere in the crowded concert hall had a revival feel. Ramsey takes the role of the itinerate preacher coming to town to preach the word. Except the salvation sought isn't freedom from sin, but debt.

In a way, the event reflects Ramsey's personal journey; a journey rooted in biblical principles and applying them to modern money problems.

For some, adding faith to finances might sound like mixing oil and water. And the combination has its critics who believe it skews too closely to the much maligned prosperity gospel and contradicts some religious ideals against accumulating wealth. But for Ramsey fans, the connection between faith and money management is seamless.

Among those fans is Michelle Singletary, a nationally syndicated personal finance columnist for The Washington Post, who finds money is one of the most talked about topics in the Bible: "How do you deal with your money? How do you stay out of debt? Don't co-sign. Be a cheerful giver. Be careful about making money your god. All of those kinds of things which apply to everybody whether you are religious or not,” she said in a telephone interview. “It just has a deeper meaning for those of us who are believers."

The mix of faith and finances seems to be resonating with many others, too. Ramsey's nationally syndicated radio show is heard by 8 million people every week on more than 500 stations. He has had four New York Times best-sellers. His video seminar on finances, Financial Peace University, has been presented to more than 2 million families at nearly 45,000 churches and other organizations.

"I'm blown away at the scale of what has happened in our lives," he tells the enthusiastic crowd.

Before he took the stage on the evening on May 14, he and his daughter sat down with the Deseret News National Edition to talk about finances, faith and leaving a legacy.

Meeting God

Deseret News: Was your journey toward God simultaneous with getting your financial life back in order?

Dave Ramsey: For me it was a key element, in my particular walk. I always laugh and say I met God on the way up and I got to know him on the way down. And so as I'm crashing and losing everything, a lot of people run to God when they are struggling. And I was no exception. I already knew him, but I ran and got closer. I started reading the word and learning what the Bible says about all kinds of things, money being one of them. And since money was the pain point, I really wanted to know what it said about money. And so it drove me into that. In that sense, our faith was the saving grace; the thing that got us through the hard times. … So, in my particular case, the biblical finance and being tied into my faith walk was my recovery. Not only my financial recovery, but my emotional, marital and everything-else recovery.

DN: How much does people's relationship with or attitude toward money affect their finances?

Rachel Cruze: As believers, we believe that we are managers of what we have been given. It's not ours. So when you function in the mentality of a manager versus an owner it changes everything. … So OK, this is God's money. He has given it to us to manage. So what do we do with it? So that is one relationship that we have when it comes to money.

Dave Ramsey: What your beliefs are about anything creates your actions. What you believe about marriage creates the way you handle your marriage. What you believe about raising kids creates the way you do that. What you believe about your career. What you believe about money. And the problem is some of us have bad beliefs. We believe the wrong things. We believe negative things that have been said to us growing up. In the neighborhood where I grew up it was a rough neighborhood, well, not rough, but it certainly wasn't upper class or anything. But I remember hearing things like, 'The little man just can't get ahead.' And if you start to believe that, then you know what, you don't get ahead.

God and gratitude

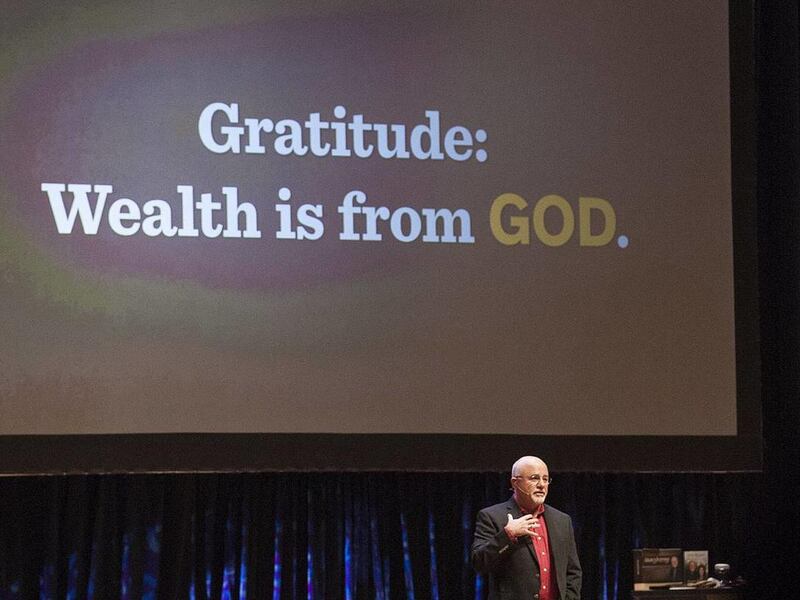

At the evening event, Ramsey walked around the stage interacting with various props — including an old pedestal kitchen table like the one he had when he went bankrupt. He told the crowd there are three views of wealth. The first he called "pride" — that wealth "is from me." The second he called the "spirit of poverty" view — that wealth "is evil." The last, and what he called the correct view of wealth, is "gratitude" — that wealth "is from God."

"(Saying) 'It's my money' there is kind of a selfishness almost in that," he said. "And I've done that. Lord forgive me."

DN: Do you ever get concerned that our lives and the economy are based upon spending and consumption?

Dave Ramsey: I think it is the old country song of looking for love in all the wrong places. There is nothing wrong with having nice things, but when you are trying to buy nice things to be happy, you are going to hurt. It's not going to work. There is a hole in your soul, (Blaise) Pascal said, and it can't be filled by stuff. There is only one thing that fills that hole, and that's God. There is a God-sized hole in your soul. … Some people try to throw stuff into the hole: bigger car, bigger house, bigger vacation, more debt associated with it. … And it just doesn't work for them.

Fame and fortune

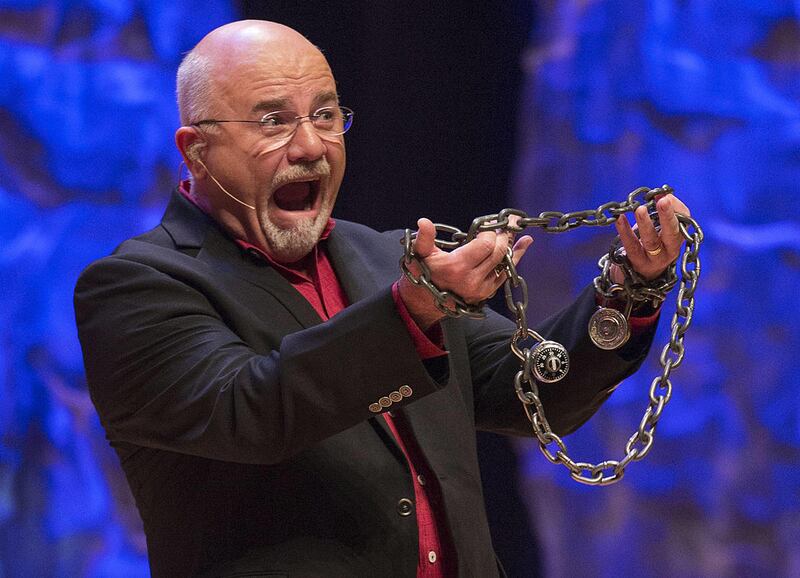

The audience showed a deep emotional connection with Ramsey when he grabbed a chain and began winding it around his wrists to show the effects of debt. "We come out with student loan debt. Then we buy a car. Then we buy a house."

With each mention of a debt, the chain bound him more and more. His voice rose and fell. The crowd responded in kind with laughs and applause. This wasn't just a show, it was their lives being depicted in cathartic crescendo.

Then, the chain was thrown aside and the shears came out, large scissors Ramsey opened and closed with a loud clippety, clippety staccato. When an audience member handed Ramsey some credit cards to cut up, the crowd yelled and hooted with encouragement.

Ramsey picked one card out, balanced it in the scissor blades before declaring judgment:

"Citibank? What's in your wallet? Money." Clip. The two halves fly off onto the stage floor.

He placed another doomed card on the blades.

"Lowes? I love Lowes. They take cash." Clip. Another card went down.

The crowd shouted as if Ramsey was a champion gladiator who defeated what he and his followers see as an evil foe — credit cards.

Since his appearance in Salt Lake City, an article in The Daily Beast recounted claims by some former and current employees of Ramsey that he doesn't tolerate criticism in the workplace. While he was in Salt Lake, he talked about fame and his critics.

DN: Isn't fame a danger? You have to market your name to do what you do. In a sense you become the product. But isn't that dangerous for you from a spiritual standpoint?

Dave Ramsey: I think scripture is pretty clear. Wealth, fame and power are tools. And, again, if you continue to realize you are not the owner of it, and you are actually not the creator of it, it's called a blessing, and the Bible is pretty clear, we were blessed so that we can be a blessing. … I got to tell you there is another side to it, and that is all the hate that you get. The dead animals in your mailbox and the hate. You know the hate mail that you get. It's strange. It's very, very strange. But you got to remember, what it comes down to is, they don't hate me. They don't know me. There is something broken in their life, and something we said touched a nerve. It touched a hurt place in them and so they erupt and say "Dave Ramsey is evil" or "you must be punished" or "we are going to kill your dog." It is all these crazy crazies out there. But, again, you got to remember, ten million people have bought my books. If 1 percent of Americans are crazy, that's a lot of crazy in my life.

Legacy and pain

Kory Scadden and his 14-year-old daughter, Sadie, stood in the lobby and talked about Ramsey's show during the intermission. People surged by them to get into various lines to buy Ramsey's books, DVDs and other items for sale with "tonight only" discounts.

Scadden and his wife took a Financial Peace University course at the local St. Paul's United Methodist Church, and he is excited to have his daughter learn some of the principles that are beginning to turn his financial life around. Sadie thinks so too. "I think it is really good to know what you should do to save up your money so you don't end up broke," she said.

"And end up living in your parents' basement," Scadden joked.

"Let's not do that!" she responded.

Scadden, who is a hospice chaplain and also teaches high school religious education classes for The Church of Jesus Christ of Latter-day Saints, said he thinks God wants people to become debt free. "When you are taking good care of your money and it is working for you, there is a lot more peace and happiness inside the family," he says.

DN: What is leaving a legacy to your family all about?

Rachel Cruze: From my perspective, being born the year (my parents) filed for bankruptcy … as they started figuring out God's and grandma's ways of handling money, if you will, they were instilling in us kids how to do that through their example. … And because of that, in our family tree, there is a generation now of us kids who don't have to feel that pain and that hurt.

Losing it

The pain of Ramsey's personal failures are in the past, but not forgotten. He brings them out often on his radio show as he advises people who made dumb mistakes. "I've got a degree in stupid," he likes to say.

His faith walk is part of who he is, he doesn't compartmentalize it, he said. You could take away his success and his core would still be there.

DN: You lost it all once. What if that happened now? If things came crashing down, where would you be?

Dave Ramsey: It would be horrible, obviously. It would hurt. … (But) the second time you get on a bike, after you balanced it the first time, you believe it. And so you balance it again. And so, if I lost everything, as long as I didn't lose my faith and lose my hope in the process, oh, it'll be back quick, really, devastatingly fast.

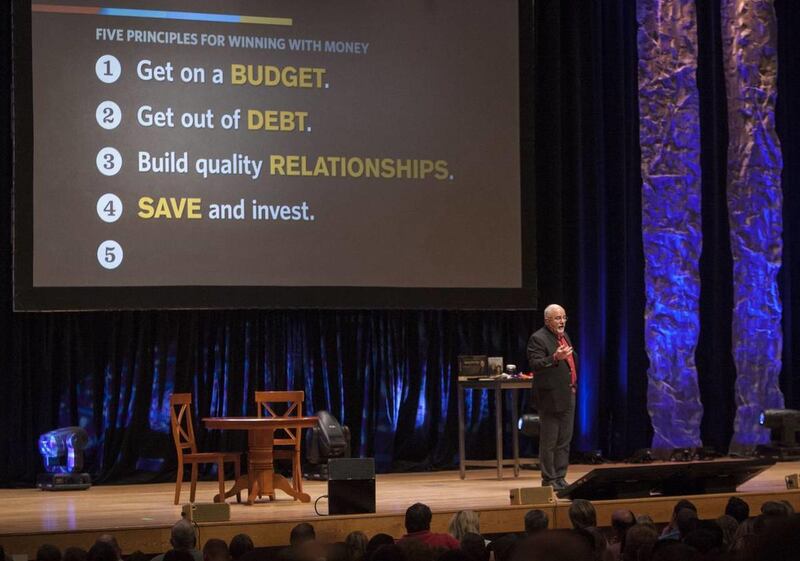

Believing

Throughout the evening, Ramsey's points are punctuated with scriptures like 1 Timothy 5:8, Proverbs 29:18, Luke 14:28. Ramsey and his daughter covered investments and teaching children how to handle money and other topics. The second half of the show moved over the material quickly. It was getting late and tomorrow there was work. And bills to be paid.

"God bless you," Ramsey said, and he was gone.

People filed out of the concert hall but they were not done. They gathered in small groups in the lobby and even outside and talk about what they learned. Things will get better. They know what to do. They are believers.

Email: mdegroote@deseretnews.com

Twitter: @degroote