SALT LAKE CITY — Experts say Utah is short on affordable housing, but newly released data suggest the Beehive State is adding homes faster than any other state.

Utah's housing growth, at just over 2 percent, outpaced every other state in a one-year window from 2016-2017, according to estimates released late Wednesday by the U.S. Census Bureau.

The gains have not averted a crisis for many Utah households bringing in less than the median income of $66,000, said Jim Wood, the Ivory-Boyer senior fellow at the University of Utah's Kem C. Gardner Policy Institute.

“Demand is still ahead of supply,” said Wood, whose research focuses on housing and economics. “What we’re seeing on the residential side is an acceleration that has been building.” Utah's estimated population of 3 million continues to grow as newcomers move in, he added.

Among those feeling the pinch are Matt Wanezek, 25, and Bailey Anderson, 24, who left Kansas City behind for Utah two months ago. The couple still is paying off student debt, so they set out to find a one-bedroom apartment in downtown Salt Lake City for no more than $900.

After glancing at apartments online, "it was clear that that wasn't going to happen," Anderson said. One-bedroom units were advertised for $1,200 a month, but the cost grew quickly with the addition of parking and other amenities.

The pressure to find a place mounted as they spent weeks staying in a hostel and with family friends. They called dozens of private landlords and property managers with inquiries, but seldom heard back. And if they weren't willing to stretch their budget on certain apartments, others were. They ultimately put down a deposit moments after touring a complex near the University of Utah on a Sunday evening in April, and signed a lease the next day.

The rent is more than double the $720 they paid monthly in Missouri.

"It's definitely painful," Anderson said.

"It hurts to say," Wanezek added.

And they are not alone. Utah's affordable housing — homes that cost no more than 30 percent of household income — is shrinking, especially in and around Salt Lake City, according to Wood.

One in 3 of Utah's roughly 1 million households pour at least the 30 percent into their homes. And 1 in 8 dedicate more than half their annual pay, according to a March analysis co-authored by Wood.

The Wednesday release shows the Beehive State's 1.06 million housing units in 2016 swelled by about 22,000 in the one-year timeframe, up to 1.08 million.

Still, the building rate growth isn't what it once was. The Utah increase and the more modest national uptick — at 0.8 percent — lag behind pre-recession rates.

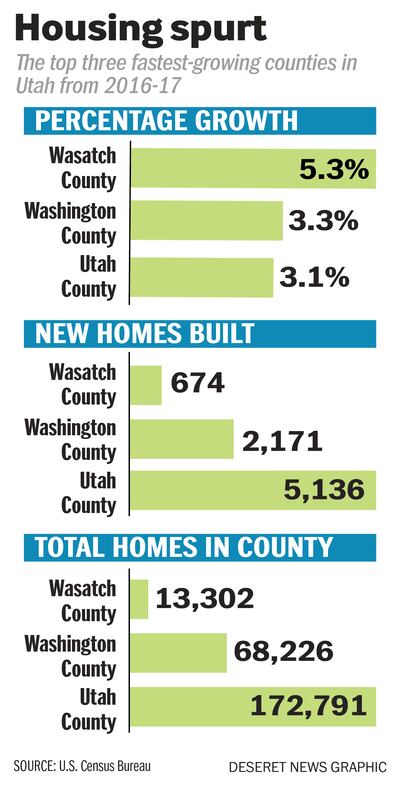

According to the release, no Utah counties saw a dip, and Salt Lake County saw the largest increase of roughly 8,000 new units. In terms of percentage, sprawling Wasatch County grew the fastest.

Outside of Utah, neighboring Idaho came in close behind, at 1.7 percent — just above Colorado's 1.6 percent.

The cluster of growing states is no surprise to Wood's colleagues who study population growth.

The Intermountain West is "where a lot of growth has been happening in the past several years. It makes sense that people need houses to live in if they're going to be moving here," said Mallory Bateman, state data center coordinator and a research analyst at the Gardner Institute.

In the broader, seven-year period dating to the 2010 Census count, Utah's growth comes in second, with a 10 percent jump. First place North Dakota's surged 19 percent. The figures draw on building permit data, factoring in regional housing loss estimates. They include houses, apartments, condos and mobile homes.

Renters are hit especially hard with "a large shortfall of affordable housing in Utah," in part due to rising fees and costs associated with development, according to Wood's analysis. Rising interest rates will only make it harder for Utahns to stay afloat.

Anderson and Wazenek, for their part, said they feel lucky they're not in crisis. But they have dipped into savings and maintain a lean grocery budget, dining in most nights on ramen or casseroles and packing peanut butter and jelly sandwiches for lunch. They spend low-fare weekends reading in parks and hiking.

And they believe their investment is worthwhile. No other city provides as much opportunity in their very different careers, they said: He works in digital advertising. She's a paleontologist.

"I'm out in the desert with nothing around, and he has to be in the heart of the city where he can prospect and do sales," Anderson explained. "I think this was the best of both worlds. There was a lot of things for me to do here geologically, in the same place where there's a quickly growing city for him to get his sales experience at the same time."

New-in-town job seekers like them are in large part responsible for the rising costs, Wood said. Newcomers to the Wasatch Front are outpacing those choosing to leave the area, creating strong demand for housing — both rental and homeownership. Demand for apartments, condos and townhouses is particularly strong.

“People move for jobs and that’s an important driver of the economic and demographic growth,” he said. It's also a key reason Wood does not believe a bust is imminent: The current surge is propelled by purely economic factors.

Wood said that data from the first quarter of 2018 suggests homebuilding in Utah continues to climb. The number of permits secured for residential construction is up about 25 percent from a year earlier. And it was the strongest first quarter since 2007, he said.

Despite the building spurt, costs will continue to rise, Wood anticipates.

And if the rising costs of new houses and meager pay increases maintain their trajectories, Utah in 26 years will look like San Francisco's dire market does today, Wood's recent analysis found.

While housing costs along the Wasatch Front are less expensive than Seattle, San Diego and Denver, they're not as competitive as those of other cities nearby. Home prices in the Salt Lake City and Provo-Orem metropolitan areas hover 20 percent higher than homes in nearby Boise, Las Vegas and Phoenix.

Correction: An earlier version of this story stated that Utah in 34 years will look like San Francisco's market does today if current trends continue. The correct timeframe is 26 years.