In the age of online shopping complicated by supply chain bottlenecks and inflationary prices, holiday shoppers have one more thing to worry about this season — cybercrime.

From email phishing schemes to fraud, the cost of cybercrime in the Intermountain West has been generally on the rise the past five years, according to data from the Federal Bureau of Investigation’s Internet Crime Complaint Center.

In last year’s holiday season, the FBI said, over 17,000 complaints had been received about the nondelivery of goods, resulting in $53 million lost to consumers nationally.

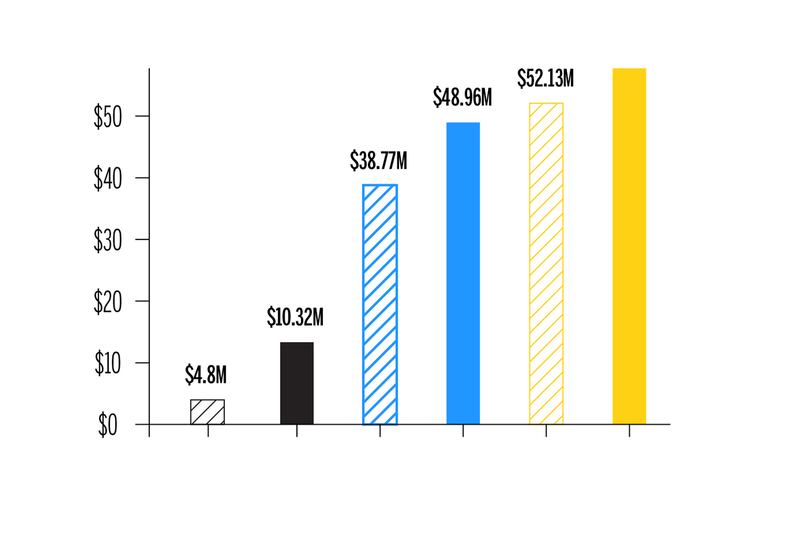

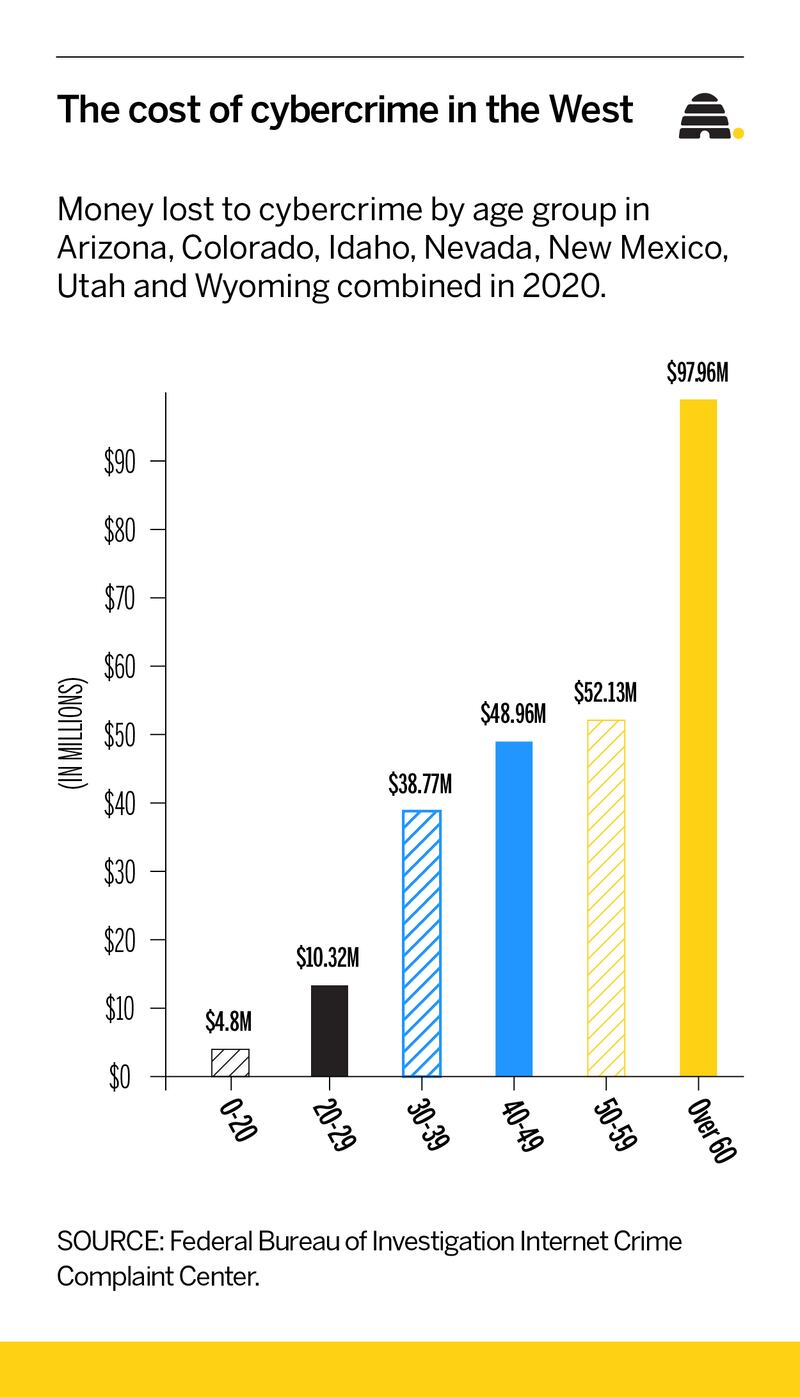

In 2020, people in Arizona, Colorado, Idaho, Nevada, New Mexico, Wyoming and Utah lost nearly $305 million combined to cybercrime. Nationally, Americans lost $4.1 billion to cybercrime, a 69% increase from 2019.

Kathy Stokes, director of fraud prevention for AARP’s Fraud Watch Network, said the rise in cybercrime is because “so many more of us are online these past two years due to COVID.”

“Criminals follow our trends (and the headlines),” she said in an email.

Utah experienced the biggest rise with a 545% increase in money lost from 2016 to 2020. State officials couldn’t attribute the increase to anything specific. But they said consumer protection officials are aware of the prevalence of cybercrime, particularly among senior citizens, and mounted a publicity campaign during Cybersecurity Awareness Month in October to educate Utahns on precautions they can take, such as password security and identifying email scams.

Of all the ways internet users can lose their money, email compromises are the most common pitfall. In the Intermountain West last year, more than $124 million was lost in either personal or business email crimes.

But the FBI data has some caveats because it is a self-reported database. A single complaint could fall under multiple crime types and a complaint may be filed more than once, officials said in the 2020 annual report. Locations of the complaints are also either entered by the complainant or otherwise known.

Those conditions create a discrepancy between the annual totals of money lost per state and the breakdown of those totals by age group.

The most common online pitfalls for consumers are email compromises, according to the FBI data. In the Intermountain West, more than $75 million was lost to either personal or business email crimes.

Colorado tops the region with $50 million lost in email compromises. State officials had an interesting take on why.

“Colorado is one of the largest and most prosperous states in the Mountain West,” a spokesperson for the Colorado Attorney General’s Office said in an email. “Criminals go where the opportunities are.”

In addition to email scams, the state saw an “influx of fraudulent unemployment claims,” something prosecutors and investigators attributed to the pandemic-induced economic decline.

“The Colorado Attorney General’s Office, law enforcement officials, and the Department of Labor and Employment launched a statewide task force in 2021 in Colorado to investigate and prosecute those who committed identity theft and used that information to commit fraud against the state of Colorado and the unemployment insurance system,” a statement said.

The attorney general’s office warned that more criminals are taking to cybercrime and getting better at it.

“Just as you shouldn’t leave your keys in your car when you park it on the street, you can’t leave your networks vulnerable to cybercrime,” the spokesperson said.

And while everyone is susceptible to cybercrime, the most vulnerable are seniors, according to FBI data.

Last year, people older than 60 in the Intermountain West lost nearly $1 trillion combined — double that of all those under 40 — from online scams.

The rise in cybercrime against seniors pushed the FBI to release its first-ever Elder Fraud Annual Report this year to raise awareness and education on the issue.

“Each year, millions of elderly Americans fall victim to some type of financial fraud or internet scheme, such as romance scams, tech support fraud, and lottery or sweepstake scams,” the report said. “Criminals gain their targets’ trust or use tactics of intimidation and threats to take advantage of their victims.”

Stokes said the statistics shouldn’t lead younger people to let down their guard against cybercrime.

“It may be that older adults are reporting cybercrimes more than younger adults,” she said. “The data only shows one part of what’s going on out there since we know scams are very underreported.”

The FBI, officials and consumer advocates ask holiday shoppers to stay vigilant and report any crime, regardless of the amount lost, to their financial institution and to law enforcement.

“It is only by victims reporting fraud that we can identify trends, educate the public, and support investigations, and nowhere is this more important than crimes against seniors,” the FBI report said.

Here are the top five types of cybercrime in seven Intermountain states, and how much they cost consumers in 2020:

Top cybercrimes in 2020 by state

| State | Rank | Crime type | Cost |

|---|---|---|---|

| Arizona | 1 | Email compromises | $30,563,349 |

| Arizona | 2 | Confidence fraud/romance | $12,068,910 |

| Arizona | 3 | Investment | $3,553,164 |

| Arizona | 4 | Nonpayment/nondelivery | $3,953,548 |

| Arizona | 5 | Tech support | $5,737,849 |

| Colorado | 1 | Email compromises | $48,491,996 |

| Colorado | 2 | Spoofing | $17,975,365 |

| Colorado | 3 | Confidence fraud/romance | $11,802,982 |

| Colorado | 4 | Identity theft | $11,039,483 |

| Colorado | 5 | Other | $10,248,775 |

| Idaho | 1 | Email compromises | $3,032,789 |

| Idaho | 2 | Investment | $2,390,809 |

| Idaho | 3 | Confidence fraud/romance | $2,126,196 |

| Idaho | 4 | Spoofing | $963,961 |

| Idaho | 5 | Credit card fraud | $760,075 |

| New Mexico | 1 | Email compromises | $9,947,912 |

| New Mexico | 2 | Confidence fraud/romance | $5,358,676 |

| New Mexico | 3 | Investment | $2,038,960 |

| New Mexico | 4 | Advanced fee | $1,615,091 |

| New Mexico | 5 | Civil matter | $1,610,416 |

| Nevada | 1 | Email compromises | $17,630,186 |

| Nevada | 2 | Confidence fraud/romance | $6,041,062 |

| Nevada | 3 | Investment | $5,959,034 |

| Nevada | 4 | Identity theft | $3,719,989 |

| Nevada | 5 | Real estate/rental | $3,202,736 |

| Utah | 1 | Email compromises | $13,186,099 |

| Utah | 2 | Other | $15,830,458 |

| Utah | 3 | Confidence fraud/romance | $6,036,574 |

| Utah | 4 | Nonpayment/nondelivery | $3,099,967 |

| Utah | 5 | Personal data breach | $2,018,413 |

| Wyoming | 1 | Email compromises | $1,256,674 |

| Wyoming | 2 | Real estate/rental | $1,230,740 |

| Wyoming | 3 | Corporate data breach | $958,000 |

| Wyoming | 4 | Nonpayment/nondelivery | $573,464 |

| Wyoming | 5 | Confidence fraud/romance | $377,214 |

K. Sophie Will is a Deseret News contributor. @ksophiewill