Hiding taxable activity, including crypto trading, may lead to trouble with the Internal Revenue Service, experts warn. In fact, the IRS has already made it clear that they’re watching.

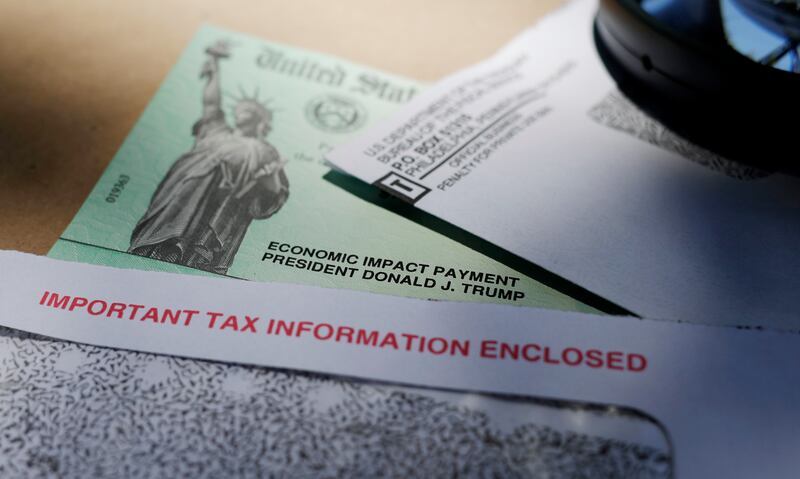

Form 1040, which U.S. taxpayers use to file their annual income tax return, has a question about “virtual currency” on the first page.

- “What is tricky is that there are a lot of really crazy things with crypto that you can do, from all the stuff around DeFi to NFTs. That’s gonna be the hard part about 2021 taxes,” says Pat White, co-founder and CEO of Bitwave, a company that helps businesses with crypto tax reporting, per Time magazine.

- “If all you’re doing is buying some Bitcoin, holding onto it and selling it six months later, then any CPA can help you with that,” says White.

How can I file for crypto taxes?

Cryptocurrency may be subject to capital gains when exchanged or sold at a profit, per CNBC. This includes swapping digital coins, cashing out for U.S. dollars or making a purchase.

- Make sure to mark yes on Form 1040 about the question related to virtual currency.

- For your individual tax return, you will have to file Form 8949 to report your cryptocurrency and NFT gains and losses, per Forbes.

- If you held on to your virtual currency for more than a year, you may qualify for long-term capital gains of 0%, 15% or 20%, depending on your income. For this, you will use Form 1099-B.

- If you have more than 200 transactions and $20,000 in gross proceeds, you need to fill out Form 1099-K, which will report your monthly activity.

- Per U.S. News, if you participated in crypto mining, you need to complete a Form 1040 Schedule C to report profits or losses.