A new survey suggests that the student loan forgiveness plan announced Wednesday by President Joe Biden reaches higher up the income ladder than most Americans want, though two-thirds say they believe some student debt relief is warranted.

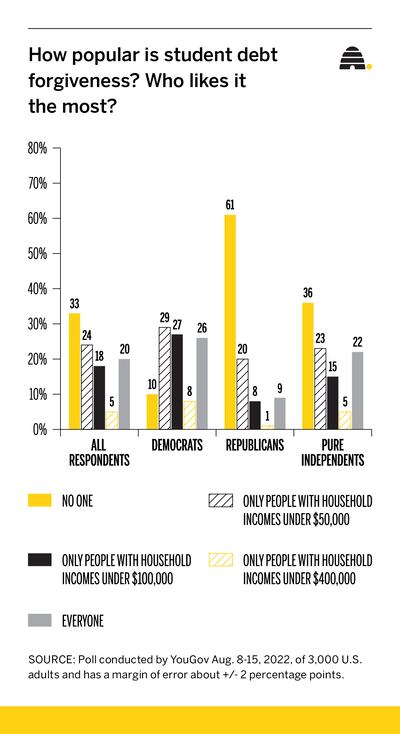

That’s according to the forthcoming American Family Survey, which will be released in its entirety in a few weeks. The annual poll found one-third of adults oppose any student loan forgiveness, while nearly one-fourth say people with annual household incomes below $50,000 should qualify.

Another 18% set the loan forgiveness level at a household income below $100,000, while 5% set the level at $400,000. Twenty percent would extend debt relief to all income levels.

The survey asked specifically about $10,000 in student debt relief, though the Biden plan offers up to $20,000 for those who had Pell Grants, which are awarded to the neediest undergraduates, based on income. The debt forgiveness plan applies to those with Department of Education loans.

The Biden plan caps the qualification for student debt relief at $125,000 in income for individuals and $250,000 for households. Those who owe less but qualify would get only the amount that they still owe.

Biden said he would also, for the final time, extend the pause on student loan payments through the end of the year. It was set to expire Aug. 31.

The White House estimated the loan forgiveness plan would wipe out student debt completely for about 20 million people and another 23 million would be eligible for some relief.

Partisan divide

The American Family Survey found that low-income and young adults are more enthusiastic about student loan forgiveness than those earning more and older adults.

Republicans are considerably less apt to support the president’s loan forgiveness plan than Democrats are. Just 1 in 10 Democrats do not want debt forgiveness at all, while 26% believe everyone who has student debt should get some relief. That is in sharp contrast with 61% of Republicans who oppose student loan forgiveness entirely and 20% who would limit it to those with incomes below $50,000.

Fewer than 1 in 10 Republicans would grant relief to all with student loans, regardless of income.

The survey, now in its eighth year, was conducted by YouGov for the Deseret News and BYU’s Center for the Study of Elections and Democracy. It polled 3,000 U.S. adults on a variety of issues that impact families and has a margin of error of plus or minus 2%. The survey was fielded between Aug. 8 and Aug. 15, 2022.

Christopher F. Karpowitz and Jeremy C. Pope, political science professors at Brigham Young University who oversee the survey, call student loan debt forgiveness “complicated.”

“Popular in some ways, it can lose popularity quickly once the details are fully understood,” they said in an email to the Deseret News.

When the American Family Survey asked how much forgiveness of student loan debt up to $10,000 would help with family finances, 18% of respondents said it would help “a lot,” while 17% said it would help “a little.” The rest said it wouldn’t make much difference.

The two note that the question was asked of all 3,000 adults who answered the survey, whether they personally had student loan debt or had even attended college.

“But despite the fact that only about a third of the public sees a personal benefit, the policy can be popular under the right circumstances,” the duo wrote. “In fact, the average amount that most respondents would be willing to pay in extra taxes for each year is over $600” — though they think that the wealthy should pay about three times more.

However, “whatever the merits of the policy, there is a fairly clear public preference for the aid to be concentrated lower on the economic ladder,” Pope and Karpowitz said.

Pope points out, too, that the survey asked about household income, not individual income, though the president’s plan has different caps for each.

A complex issue and response

Karpowitz, who directs the Center for the Study of Elections and Democracy at Brigham Young University, emphasized the difference based on age in how people responded to the question of impact. “Not surprisingly, but importantly, this is something that affects young people more than older people.”

“The effect of age is clear,” he said. “Young people are significantly more likely to say that student loan forgiveness would affect them. For those under 45, one-fourth of respondents say that it would make a large difference for their family finances, and for those under 30, a majority say it would make at least a little difference.”

Karpowitz said it’s possible that extending debt forgiveness up to $20,000 for those who have Pell Grants would increase the number saying it would affect their family finances, but the survey only asked about $10,000, which is what most who receive the aid would get.

Pope said he thinks the Biden proposal attempts to “thread the needle” to craft a policy that’s popular with Democrats, but won’t anger the broader electorate. Time will show, he said, if the president succeeded. “We’ll see how it plays out in public debate. I’m curious to see how it goes.”

And he said he expects the proposal to raise some questions, including why someone going to a top-tier school like Harvard and will eventually make a lot of money needs loan forgiveness. “But of course, there’ll be other people who will have very sympathetic stories, like someone who went to community college and racked up debt to get a nursing degree who says, ‘This makes a huge difference to me,’” Pope said.

He also noted that people are interconnected in different ways, and there are a lot of people who are not directly impacted who will still care about the plan, including parents and grandparents of those who will benefit. Family interactions are, he said, “wide and diverse and complex,” so reactions will vary a lot depending on circumstances.

Pope said some people who are older will support student loan forgiveness “simply because they’re really invested in the education of some of those young people.”

Different reactions

The Associated Press reported on reaction to the plan, noting that legal challenges are all but assured. If the proposal survives those, the article said, “it could offer a windfall to many in the run-up to this fall’s midterm elections. More than 43 million people have federal student debt, with an average balance of $37,667, according to federal data. Nearly a third of borrowers owe less than $10,000, and about half owe less than $20,000.”

Despite enthusiasm from young adults with student loans and Democrats, among others, AP noted opposition to the plan, as well, quoting Senate Minority Leader Mitch McConnell, who said, “President Biden’s inflation is crushing working families, and his answer is to give away even more government money to elites with higher salaries. Democrats are literally using working Americans’ money to try to buy themselves some enthusiasm from their political base.”

A federal student aid page contains information on the plan. The U.S. Department of Education said that people can sign up to get information on when the process begins on its website subscription page.