- The K-shaped economy describes a growing divide between higher and lower wage earners.

- A red hot investment market, driven by AI development, has widened the K-shaped divide.

- Americans and Utahns identified inflation as their top concern in a new poll.

To borrow a phrase made famous by Sesame Street, today’s economy is brought to you by the letter K and the number 175,000.

Adopting letters as stand-in descriptors for economic conditions is a long-standing practice that includes L-shaped, a sharp decline followed by an extended period of stagnation. V-shaped, an abrupt dip followed by strong rebound. W-shaped, also known as the double-dip, wherein a recession is followed by a recovery then a secondary decline. U-shaped conditions when a recession is followed by a period of stagnation ahead of a gradual recovery.

The K-shape is the newest addition to the economic letter lexicon and is widely attributed to American economist and William & Mary professor Peter Atwater who coined the term in 2020.

Atwater used the K shape to describe an economic bifurcation that occurred amid pandemic conditions as white collar workers were able to transition to work-from-home assignments relatively easily and maintain their incomes, while blue collar workers, whose jobs mostly required an in-person presence, suffered severe economic impacts.

Now, that K represents a broader separation of the haves and have-nots in the current U.S. economy where higher income Americans, represented in the upper arm of the K, are prospering as their wealth, vested largely in the stock and real estate holdings, is on the rise. Most U.S. households, however, are tracking with the downward K arm as inflation, rising housing costs and slowing wage growth pushes lower level earners into more dire economic straits.

So, where do you fall in the K-shaped economy?

In a recent podcast discussion, Mark Zandi, chief economist for Moody’s Analytics, identified the household income line separating those in the upper and lower arms of the K-shaped economy as roughly $175,000. If your earnings are over that threshold, as are around 20% of U.S. households, your fiscal health is likely solid and moving in a positive direction. But the 80% of households that fall under that figure are facing diminishing prospects and more serious challenges amid the current economy.

Phil Dean, chief economist for the University of Utah’s Kem C. Gardner Policy Institute, explained that a closer look at the typical household’s expenses versus income and assets reveals the factors behind the K-shaped divide.

Dean notes U.S. households in the upper earning tiers that draw income from investments are benefitting from stock markets that have seen stellar growth this year. So far in 2025, the S&P 500 is up around 17% and the tech-heavy Nasdaq Exchange has grown by over 20% from the first of the year.

Federal Reserve data reveals that about 87% of the U.S. stock market is owned by the top 10% wealthiest Americans while the poorest 50% own just 1.1%, per a recent report from the Associated Press.

Dean said that, along with investment market growth, real estate values have skyrocketed in the past few years, building equity and additional wealth for those who own their homes. But the same dynamic has also driven up prices for those that reside in rental properties, putting further strain on family budgets and eroding opportunities to save and get ahead.

And persistent inflation impacts lower income households in a regressive fashion, where the cost of basic necessities represents a much larger portion of overall income compared to higher income families.

“There is mounting pressure among younger earners and those at the lower income levels,” Dean said. “For example, when food prices go up, the added cost has a larger impact on lower- and middle-income households while high-income households are better able to navigate it … and may not even notice the changes.”

What Utahns are saying about their household fiscal health

Recent polling by the Deseret News/Hinckley Institute of Politics finds that rising prices on consumer goods and services are the number one economic worry as reported by respondents in both national and statewide audience samples.

When asked to identify their top economic concern, 44% of Americans and 47% of Utahns identified inflation as their top concern. The next biggest concern was housing costs, picked by 18% of Utahns and 13% of Americans. Rounding out the top four for both sample sets was having enough money saved for retirement and concerns over potential job loss.

While inflation worries were top of mind in Utah across income categories, housing costs were more prevalent among those earning less than $50,000 per year and between $50,000-$100,000 per year where about one in five chose it as their top economic issue. Among those in the national survey, housing cost concerns were the top issue for 7% to 12% of respondents, depending on their income level.

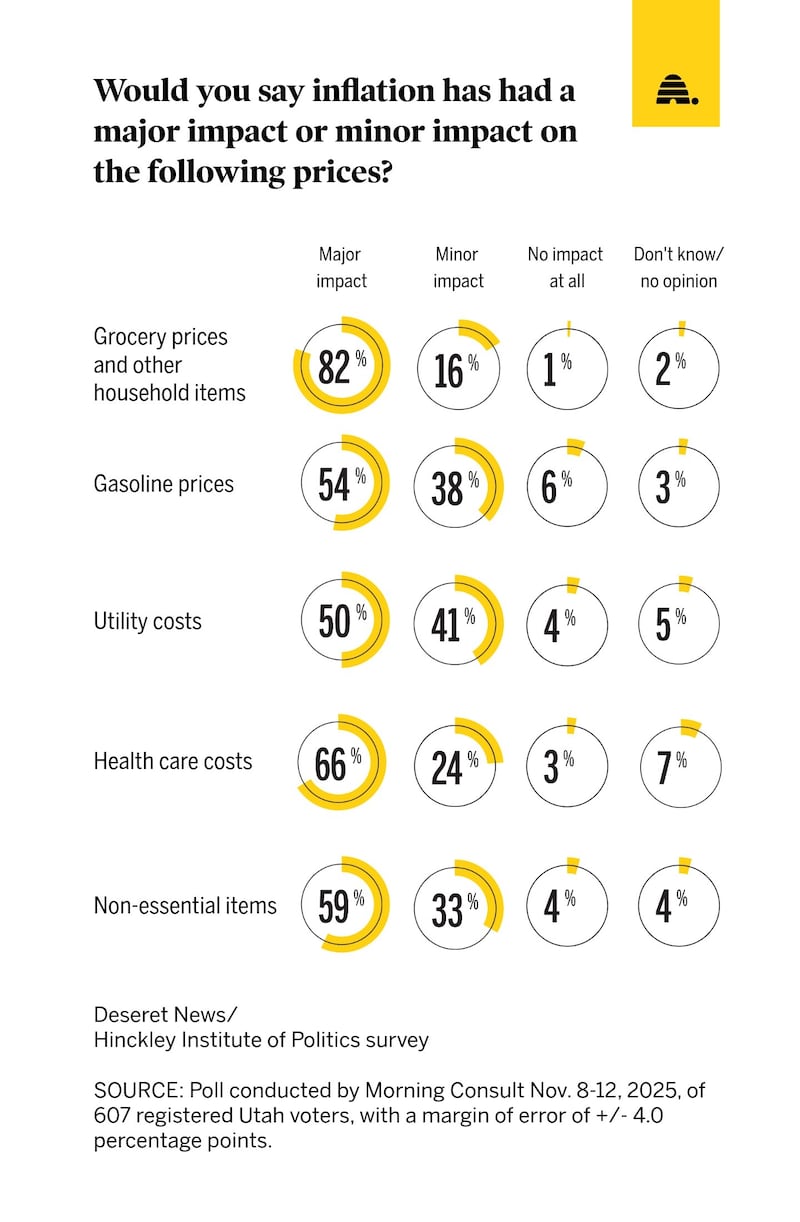

When asked to rate the inflation impacts on various household spending categories, both national and statewide survey participants said grocery prices were the most affected by inflation followed by the costs of housing, health care, utilities and gasoline.

The power of high earners

Beside being better situated to weather the impacts of current economic conditions, higher earners are playing an outsize role in driving a U.S. economy in which consumer spending accounts for two-thirds of overall economic activity.

Data analysis by Zandi found the top 10% income tier accounted for 50% of consumer spending in the second quarter of 2025.

During an earnings call last month, Best Buy CEO Corie Barry said that the top 40% of all U.S. consumers are driving two-thirds of all consumption, according to a report from the Associated Press.

The remaining 60% are focused on getting the best deals and are more dependent on a healthy job market, Barry said.

“One of the things we’re watching closely is how does employment continue to evolve for particularly that cohort of people who are living more paycheck to paycheck,” Barry added.

Will the K go away?

Much of the growth in U.S. stock market value over the past year, and subsequent income gains for households with market holdings, has been driven by investor enthusiasm for companies engaged in artificial intelligence development. While those companies are investing hundreds of billions of dollars in building out AI infrastructure, such as data centers and advancing AI-driven software platforms, Atwater pointed out that the massive capital input has yet to flow down to the level of the working class.

“What we see at the very top is an economy that is sort of self-contained ... between AIthe stock market, the experiences of the wealthy,” Atwater told AP. “And it’s largely contained. It doesn’t flow through to the bottom.”

BYU economics professor Christian vom Lehn notes that AI’s outsize impact on investment markets prompts questions about sustainability.

“There are rapid advances in AI tech… and there are real economic gains going on here,” vom Lehn said in a Deseret News interview. But the economist underscored that “there is an enthusiasm level that may be running ahead of reality.”

“How much of the boom is based on real economics versus irrationality will take some time to tease out,” vom Lehn said.

If the AI investment sector were to experience a market correction event and should the stock values of companies heavily invested in the technology tumble, that could alter the current rising trajectory of those in the top arm of the K-shaped economy.

Alternatively, conditions for the majority of Americans who find themselves facing the challenges inherent to the bottom K arm could transition to better economic circumstances.

Dean points out that even amid the somewhat dour national economic climate of the moment, there are bright spots.

“There are a lot of opportunities for wage growth and job growth in areas that require technical training … and within those areas there are a lot of job opportunities,” Dean said.

Dean also likes Utah’s prospects amid the K-shaped economy, noting that while overall growth across the state has moderated, recent state-level data reflects sales tax collections were up around 5% in October and income tax withholding figures, which capture both job and wage growth, were up about 3%.

National economist Zandi was in the Beehive State in October as part of the University of Utah’s Societal Impact Seminar and weighed in on Utah’s economic environment at a press briefing during his visit.

He said Utah’s fiscal vitality is thanks in large part to the state’s diverse economic portfolio and noted other factors that bolster Utah’s unique resilience to outside impacts.

“The one thing as a visitor to Utah that strikes me is how cohesive the politics are as well as a social fabric very different from where I come from,” he said. “I live in Philadelphia. Pennsylvania has a much more fractured political process, and that makes it much more difficult to address ... very pressing issues. But Utah is in an enviable position with regard to that kind of social cohesion. I think it’s very important.”