The United States has the most progressive income tax system in the industrialized world, and the wealthiest 10 percent here pay a greater share of the tax burden than do the wealthiest 10 percent in other nations that are members of the Organization for Economic Cooperation and Development.

That includes nations such as France, Italy and, yes, even Sweden.

In addition, the tax burden here has become more progressive over time, and a rising percentage of Americans pay no income tax at all.

Those were just some of the conclusions of a newly released Tax Foundation study, just in time for April 15. They ought to inform debate about how to fix the nations economy and institute long-range deficit reduction. Chances are, though, youll still hear the left shouting about making the rich pay their fair share.

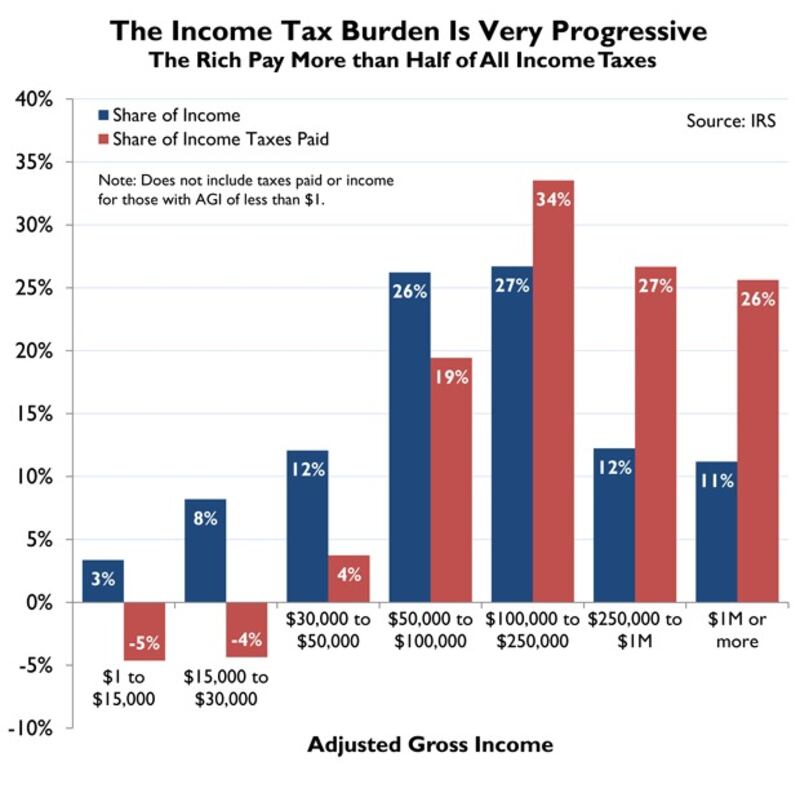

Look at this chart from the report:

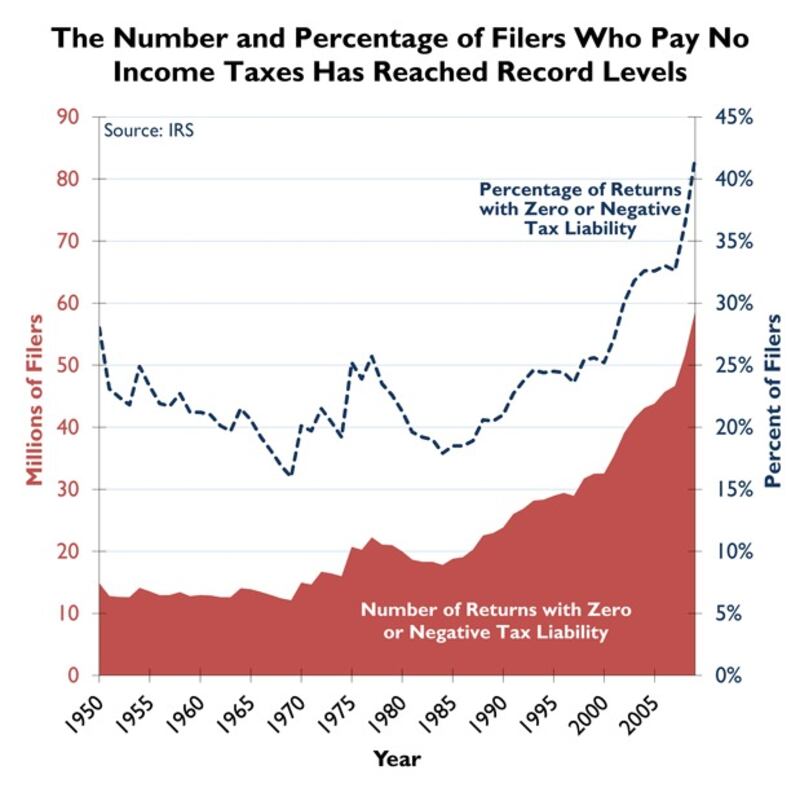

This illustrates which income levels pay the most. The chart below shows the growing percentage of those who pay no income tax at all.

The report contains the example of a family of four earning $45,000 who takes advantage of credits and deductions and ends up owing nothing and receiving a nice refund.

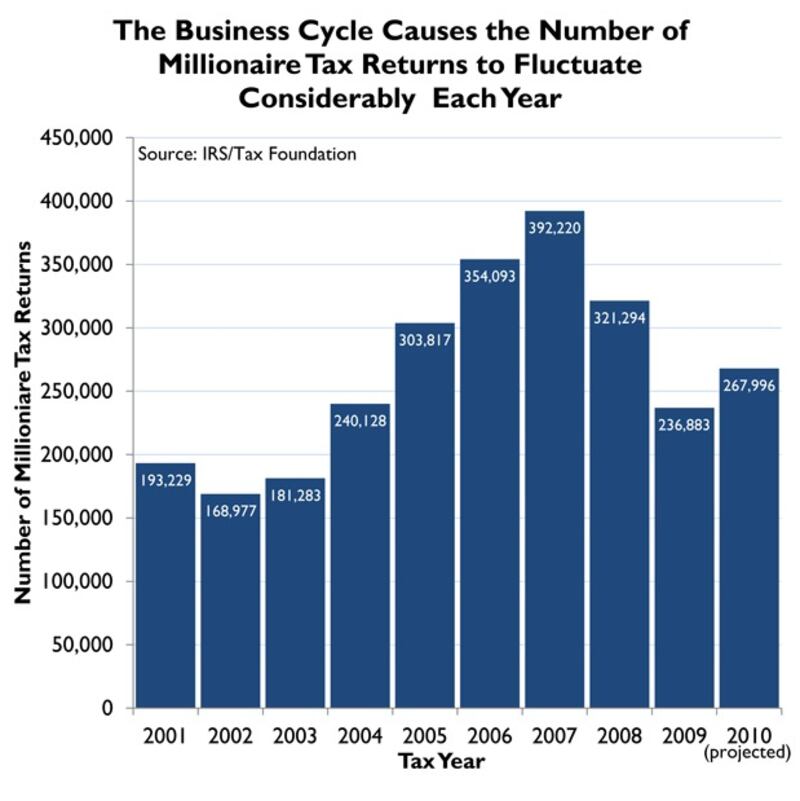

The chart below shows that being a millionaire is not necessarily a permanent thing.

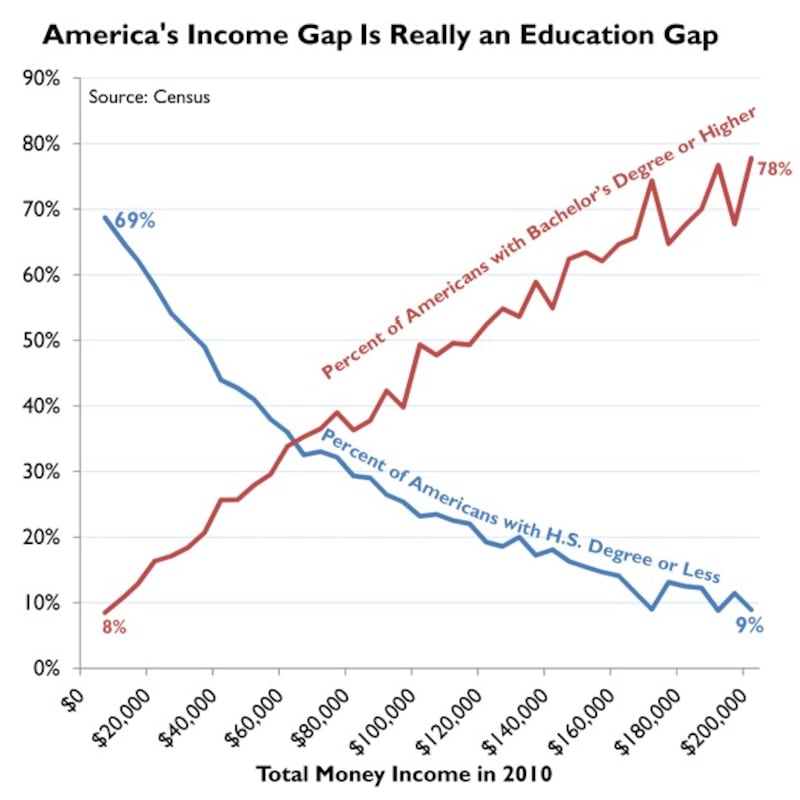

And the next chart demonstrates that the nation doesn't have a wage gap so much as it has an education gap. The greater your level of education, the more money you make. Perhaps that ought to be more of an emphasis with government spending.

I don't have room to include all the charts here. The report itself is worth reading. Just click on this text and go see for yourself. The Tax Foundation is a non-partisan think tank interested in sensible tax policy.

The report's conclusion is that the nation needs fundamental tax reform in order to restore its competitiveness and put it on the path to growth.

That takes hard work, though. Don't count on it.