Many Americans know former Utah Sen. Reed Smoot only from the 1986 film "Ferris Bueller’s Day Off." As students struggle to stay awake, the monotonous teacher (played by Ben Stein) drones on about the “tariff bill — anyone, anyone — the Hawley-Smoot Tariff Bill.”

When no one responds, Stein asks, did it work? “No, it did not work, and the United States sank deeper into the Great Depression.”

The 1930 tariff bill, sponsored by Oregon representative Willis Hawley and Sen. Reed Smoot, stands as a dire economic and political warning for anyone tempted to distort markets or arbitrarily control consumer choice.

In 1902, the Utah State Legislature elected Reed Smoot to the United States Senate. At the time, Smoot also served as a member of the Quorum of the Twelve Apostles of The Church of Jesus Christ of Latter-day Saints. As the first active church leader elected to the Senate, Smoot immediately ignited a ferocious national debate.

Although Smoot practiced monogamy, Washington still vividly remembered the antipolygamy campaigns targeting the church. The Senate refused to seat him and launched a four-year investigation into whether the church still sanctioned polygamy and whether a sitting Latter-day Saint apostle could act independently.

After church President Joseph F. Smith endured grueling testimony and President Theodore Roosevelt intervened — hoping to curry Republican favor in Utah — the Senate failed to muster the two-thirds vote required to expel Smoot.

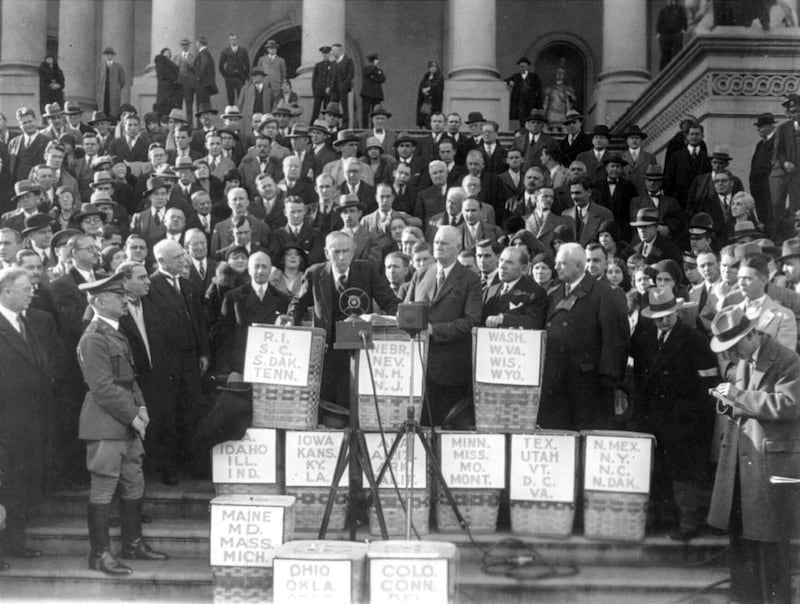

Despite this initial controversy, Smoot served for 30 years. He advised multiple Republican presidents and eventually chaired the powerful Senate Finance Committee. After the 1929 stock market crash, the United States plunged into the Great Depression. Smoot grew particularly concerned as agricultural prices collapsed, pushing farmers across the country toward bankruptcy.

Sugar beets were a cash crop for many of Smoot’s constituents. But sugar beets could not compete with cane sugar from Louisiana, the Caribbean and South America.

Smoot, who was sometimes nicknamed “Senator Sugar,” argued that a tariff on sugar would stem the flood of cheap Cuban and Brazilian imports and prop up prices for an industry on the brink. As Smoot partnered with Rep. Hawley to sponsor the bill, other members of Congress piled on protections for their favored industries. Supporters believed tariffs would force Americans to buy domestically, stimulate demand and restore prosperity.

Desperate for any solution as his administration unraveled amid conflict with the Bonus Army and other crises, President Herbert Hoover signed the bill into law in 1930. The legislation raised the average effective tariff to roughly 19% — among the highest rates in American history.

Initially, the policy appeared to work. Prices rose and briefly stimulated economic activity. But the gains proved short-lived. As Dartmouth economist Doug Irwin explains in "Peddling Protectionism: Smoot-Hawley and the Great Depression," the real damage came from foreign retaliation. Other nations shut their markets to American goods, demand collapsed, unemployment surged, wages fell and the economy sank even deeper into depression.

The 1932 election devastated Republicans. However, they shouldn’t have been surprised. Tariffs had always been economically distortive and politically unpopular. Tariffs set by King Charles I led to the English Civil War in 1642 that resulted in a weakened monarchy. The Townshend Acts were one of the main grievances that sparked the American Revolution, due to tariffs on glass, paint, lead, paper, and tea imported into the American colonies from Britain to raise money for the monarchy. As a young Congressman, William McKinley lost his house seat in the Democratic landslide of 1890 when he sponsored the highest tariff rates of his day. Later, after a stint as governor of Ohio, McKinley left his tariff policy behind when he became president in 1897.

In the wake of Smoot-Hawley economic challenges and the depths of the Great Depression, the GOP lost 101 seats in the House of Representatives in the 1932 election. With senators now elected by popular vote under the 17th Amendment, Utah voters chose to retire Smoot for his support of tariffs. The outcome proved remarkable: Even in a state dominated by Latter-day Saints, the apostle-senator could not escape the political quicksand.

Today, 2025 feels like a mixtape of counterproductive economic policies long debunked by history. Yet unlike Smoot-Hawley, current tariff rates did not emerge from Congress but from executive fiat.

This expansive use of presidential “emergency” powers to impose taxes without representation would have made King George III blush — and offend the very sensibilities of liberty that once sent tea into Boston Harbor.

These policies also create a terrible precedent, since a future progressive president could simply declare an emergency on climate change to raise gas and energy prices without consent of Congress.

In the wake of the latest job report, the administration argues current economic progress reflects, in part, how tariff and trade policies had touched off “an export boom.” But most analysts see economic growth as a product of something more complex. Namely, health care consumption (growing as the Baby Boomer generation begins to age) and luxury consumption by high income earners. In the meanwhile, consumption by middle and low income families has begun to slump given higher retail prices.

Despite the White House’s claims of a new tariff-driven Golden Age, three alarming trends are emerging that despite the higher GDP growth from latest reports, should give policymakers and voters pause:

- Prices remain elevated, particularly for food and other retail goods. The Federal Reserve sets a 2% inflation target but the latest CPI numbers seem to be unmoved from around 3%. While this may sound small, it is a 50% increase over target and is expected to be continually compounded as prices rise faster than wages.

- Manufacturing employment slumps. Since April, manufacturing employment has dropped, ironically, since this has been a focus of the administration. One paradox of tariffs is that they are intended to protect domestic jobs, but extensive import taxes on foreign steel or parts eliminates profits in industries that transform those raw materials into final goods and services. For instance, recent evidence shows minimal gains to the steel industry from tariffs in the mid 2000s, but every other segment of manufacturing was harmed. That results in increased prices to the consumer and diminished wages to the worker.

- The affordability crisis, particularly in housing, is exacerbated. Tariffs against Canada (partly in response to an ad aired by the Ontario provincial government featuring Ronald Reagan) raise lumber prices. Homebuilders have to pass these increased costs to the buyer during a housing crisis.

All these trends work together. These tariffs are now freezing the labor market. After years of inflation, consumers refuse further price increases, so firms have turned to layoffs and wage cuts instead. The latest jobs report shows hiring has flatlined since April’s so-called “liberation day” — an oxymoronic label for tariffs. This stalemate locks new workers out of jobs and stalls the upward mobility of others. Retaliation has also crippled American agriculture, as foreign buyers source their food elsewhere.

Most disappointing of all, Congress has abandoned its Article I power of the purse, surrendering it at the expense of its own constituents. Yet for those ready to give up on America’s balance of powers, the Supreme Court is set to weigh in on the tariffs soon, as early as January. During oral arguments earlier this fall, the Supreme Court expressed skepticism that the tariffs were constitutional.

Conservatives should hope congressional Republicans learn from the ghosts of tariffs past and reverse course before the coming midterms. In the meanwhile, Americans may soon wish they had heeded the wisdom of philosopher Friedrich Hegel’s famous and oft-ignored line: “We learn from history that we never learn anything from history.”