Are Utahns experiencing COVID-19 stimulus fatigue?

Maybe not, but data from a new Deseret News-Hinckley Institute of Politics poll shows over half of residents don’t consider the latest, and most generous, round of stimulus checks to be that big a deal.

The survey, conducted by Scott Rasmussen on March 26-31 of 1,000 registered Utah voters, found that 54% of respondents rated the third round of stimulus checks/direct deposits that started going out last month as either “not very” or “not at all” important to their current financial situations. The poll has a 3.1% margin of error.

So far, the federal government has disbursed three rounds of checks to individuals with the goal of stimulating spending amid recession conditions wrought by the COVID-19 pandemic.

Last March, following passage of the nearly $2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act, many U.S. taxpayers became eligible for payments that provided $1,200 for each eligible adult and $500 for each dependent child.

In December, another round of “economic impact” payments went out, this time granting $600 to each eligible adult and $600 per dependent child. And, most recently, the $1.9 trillion American Rescue Plan provided funding for $1,400 checks to adults and another $1,400 to children. Each plan came with earnings caps on full stimulus payments that ranged from $80,000-$99,000 for single filers and $160,000-$198,000 for those filing joint returns.

And even though a solid majority of Utahns may not be in dire need of the most recent wave of federal assistance, 46% of those polled said the money was going to be “very” or “somewhat” important to their personal financial affairs.

Among those was Bree Robinson of Beaver.

Robinson, 43, said even though pandemic restrictions resulted in a severe slowdown of her family’s collision repair business, they were able to navigate the hardships through frugality and tightening up the budget. And while she has yet to see the latest round of stimulus money, it’s expected and the money will go into savings, as have the first two payments of federal assistance they’ve received.

Robinson works as a teacher’s aid, but is also part of the family repair business, which is headed by her husband and also includes two of their teenage daughters among the staff.

Robinson said she’s grateful to have the money as backup, particularly as rising gas prices are impacting company expenses. She is also anticipating business tax rates could go up under the new administration.

“Being self-employed changes things,” Robinson said. “When taxes fluctuate and fuel fluctuates it has a really big impact on our business.”

Robinson said that while business volume at the repair shop is almost back to where it was before the COVID-19 outbreak, she and her husband are happy to have the backup savings the stimulus funding has provided to help ensure “we can come out of this in good shape.”

Personal saving habits have skyrocketed amid COVID-19 conditions, a fact noted by JPMorgan Chase CEO Jamie Dimon in a panel discussion earlier this week. Dimon, who runs the largest financial institution in the world when measured by market capitalization, said in a conversation with former Utah Gov. and U.S. Ambassador Jon Huntsman Jr. that Americans had grown their personal savings and checking account balances by some $2 trillion over pre-pandemic levels, and that’s even before the latest round of stimulus cash.

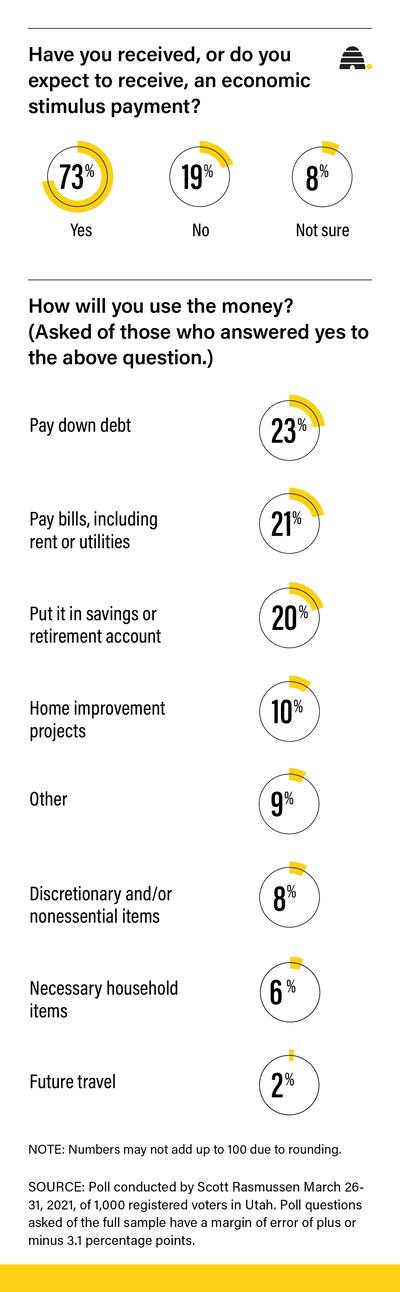

When pollsters asked Utahns who had received stimulus checks how they’d used or planned to use the cash, savings came in third with 20%, just behind paying down debt (23%) and paying bills including rent or utilities (21%). Home improvement projects also made the top four responses with 10% of respondents saying they planned to plough the money into their abodes.

Utah results were very similar to national data collected by the U.S. Census Bureau in February that also asked how people were planning on putting stimulus money to work.

The Household Pulse Survey allowed respondents to make multiple choices, but of the sample set of 110 million Americans, some 52% said paying down debt would be among their top priorities, followed by 44% prioritizing paying household-related expense and 19% saying it would go into savings.

Murray resident Jay Lalik, 40, was at ground zero of the early COVID-19 economic impacts, losing his restaurant job amid statewide restrictions on public gatherings. A follow-up gig with Amazon wasn’t a good fit, but Lalik is now with a private security firm.

He said the stimulus checks he’s received were not unappreciated but he isn’t a fan of handouts. And, he also felt compelled to bank the money as a hedge against cost-of-living increases, which he said are already becoming apparent in Utah.

“The money wasn’t vital, and I’m usually kind of averse to this type of thing,” Lalik said. “But with all the money that’s just being printed right now, I felt like I had to have it just to keep up with inflation.”

Lalik said he believes the economy will continue to pick up as restrictions are reduced and vaccination rates continue to rise, and he sees a positive road ahead for his personal financial outlook. But he is also concerned by indicators, like recent gas price increases, that may portend higher prices on everything in the not-too-distant future.

“I know the (Federal Reserve) has a lot of tools to keep inflation at just a few percentage points,” Lalik said. “But watching how fast fuel prices are going up seems like a sign that we’re going to see ... even more price increases.”